December 6, 2023

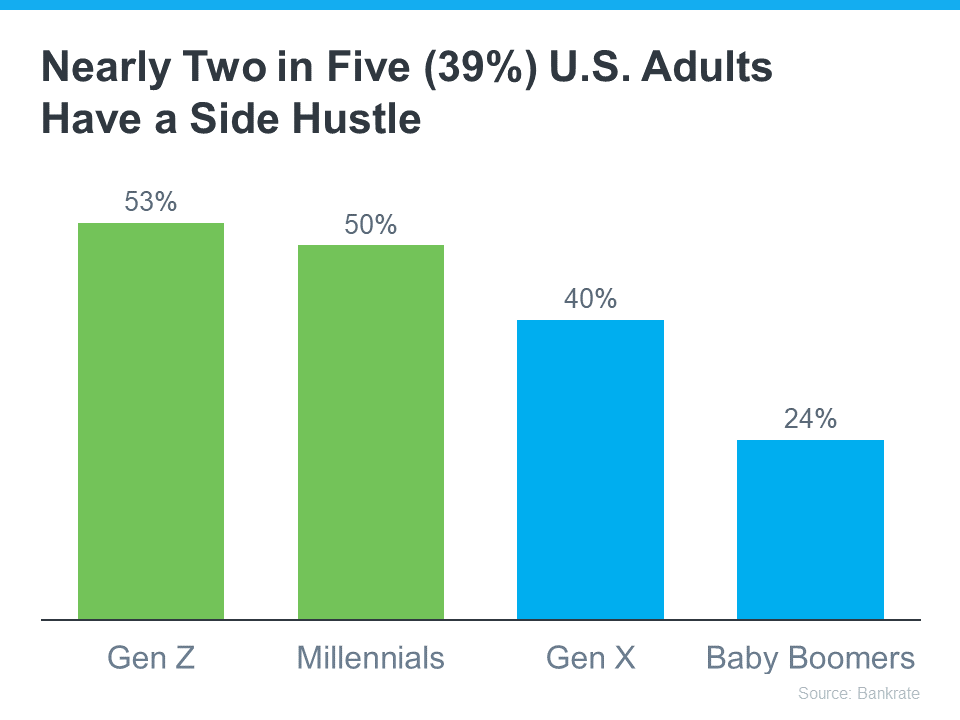

Are soaring costs and financial constraints making the dream of owning your home seem out of reach? As per Bankrate, many are turning to side hustles to tackle increasing expenses and save for a home. This trend is particularly popular among younger individuals dealing with student loan debt.

Strategy 1: Transforming a Fixer-Upper into Opportunity

Consider breaking into homeownership by investing in a fixer-upper. These homes, less appealing and lingering on the market, offer an affordable entry point. U.S. News highlights the advantages:

“A fixer-upper that needs some updating and a little love can feel like a welcome alternative to move-in ready houses.”

Benefits:

- Increased affordability with a lower entry price.

- Potential for future profits as you enhance and increase the home’s market value.

- Building equity for future returns.

Strategy 2: Renting Out a Portion for Affordability

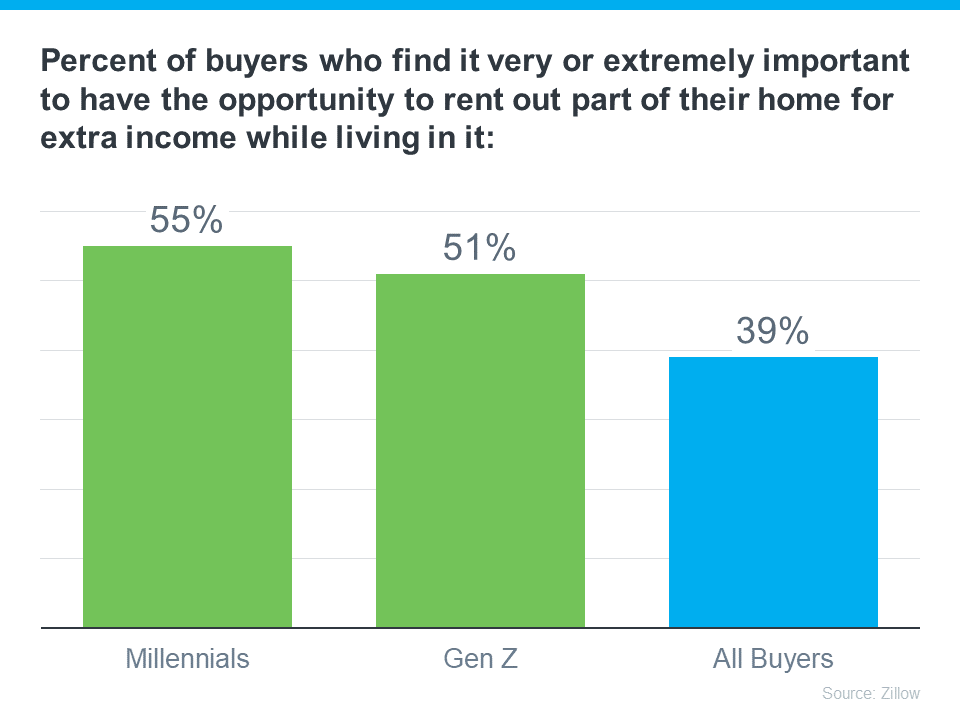

Purchase a home with the intention of renting out a portion upfront. Zillow reveals that renting out part of a home is crucial for many young homebuyers.

Manny Garcia from Zillow emphasizes:

“For those first-time buyers navigating the ‘side hustle culture,’ where a regular 9-to-5 might not quite cut it for homeownership dreams, rental income can step in to help . . .”

Benefits:

- Affordability: Rental income can contribute to monthly mortgage payments.

- Positioning yourself as an investor, turning your home into a source of income.

In the face of affordability challenges, these strategies offer attainable paths to homeownership, particularly for younger buyers. To explore how these options might work for you in our local market, let’s connect.