Envision your future. Career success, financial security, and your life’s goals. Does homeownership feature in your vision? If it does, you’re in for a wealth-building journey.

Owning a home is a potent tool for financial stability and wealth creation. Home values are on the rise, exemplified by Zillow’s data:

“The U.S. housing market’s total value, comprising Zillow’s estimates for all U.S. homes, is approaching $52 trillion, a remarkable $1.1 trillion surge from the previous peak last June.”

In essence, homeownership is a cornerstone of wealth accumulation, with home values surging nationwide. This is the ideal time to explore homeownership’s potential impact on your financial well-being.

Let’s delve into the statistics to grasp how homeownership can truly transform your life.

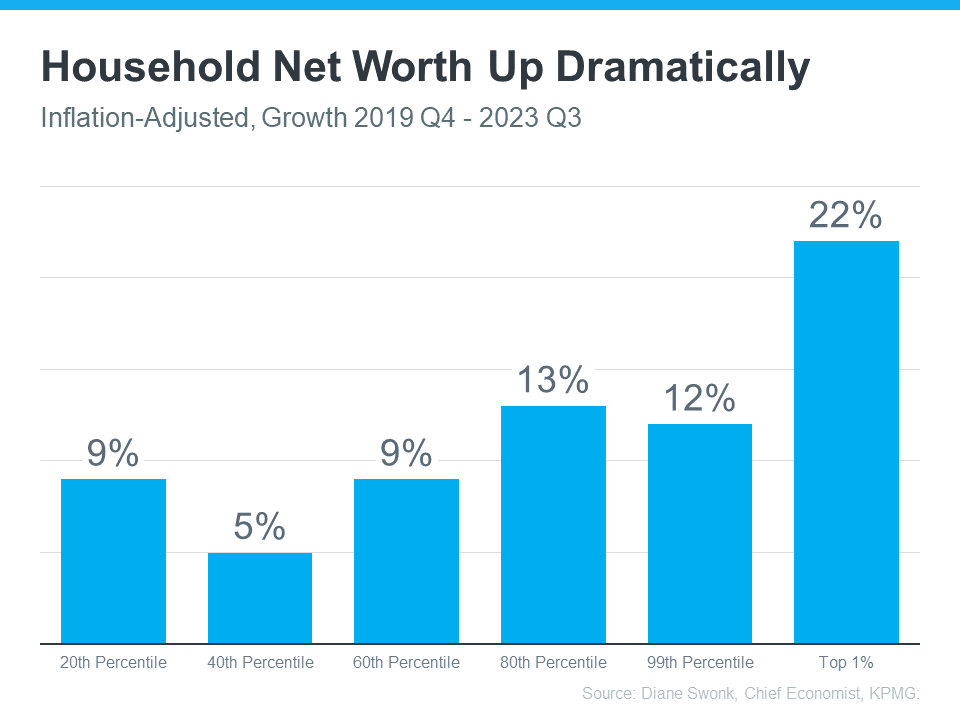

Household Net Worth Is Soaring Data underscores the growth in wealth across various income brackets. Even the top 1% has witnessed substantial net worth growth in recent years, as depicted below:

Among those experiencing wealth growth, the appreciating value of their homes plays a pivotal role.

Owning a Home: A Path to Financial Success The disparity in net worth between homeowners and renters is evident. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), highlights:

“Homeownership is a catalyst for building wealth for people from all walks of life. A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter.”

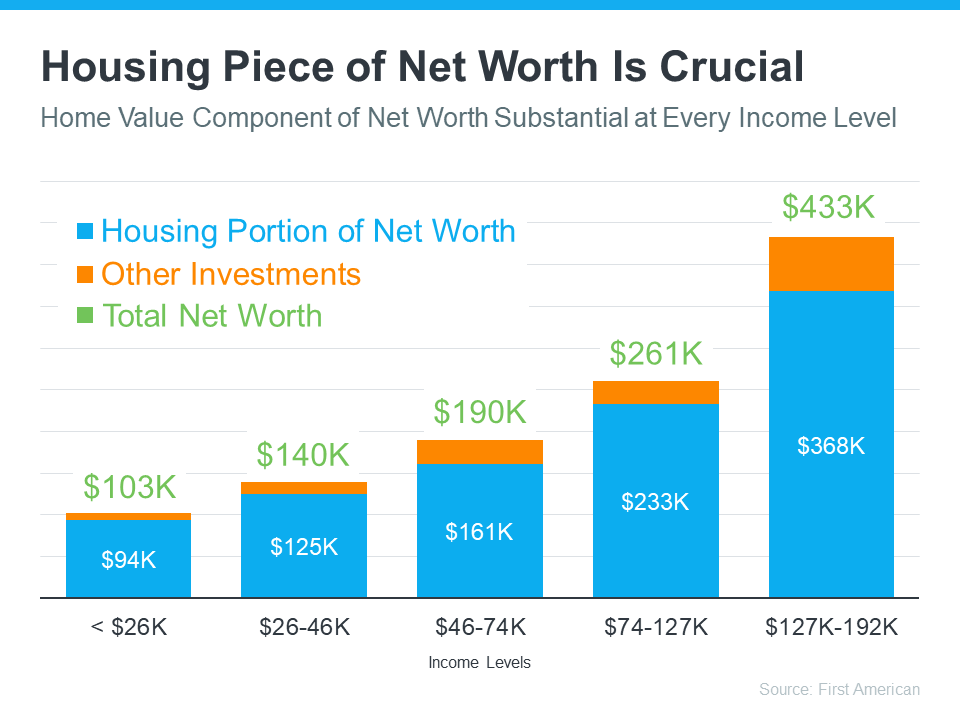

The key driver? Homeowners build equity. Home equity represents your home’s value minus your mortgage balance – for most homeowners, the single largest contributor to their net worth. First American’s data reinforces this point:

The blue portion in each bar symbolizes housing’s share of net worth, clearly surpassing other investments such as stocks, gold, and cryptocurrencies. Irrespective of income levels, homeownership is the linchpin of enhancing the typical household’s wealth.

In Conclusion Owning a home offers a prime opportunity to boost your net worth. Let’s connect and embark on your journey to invest in homeownership.”