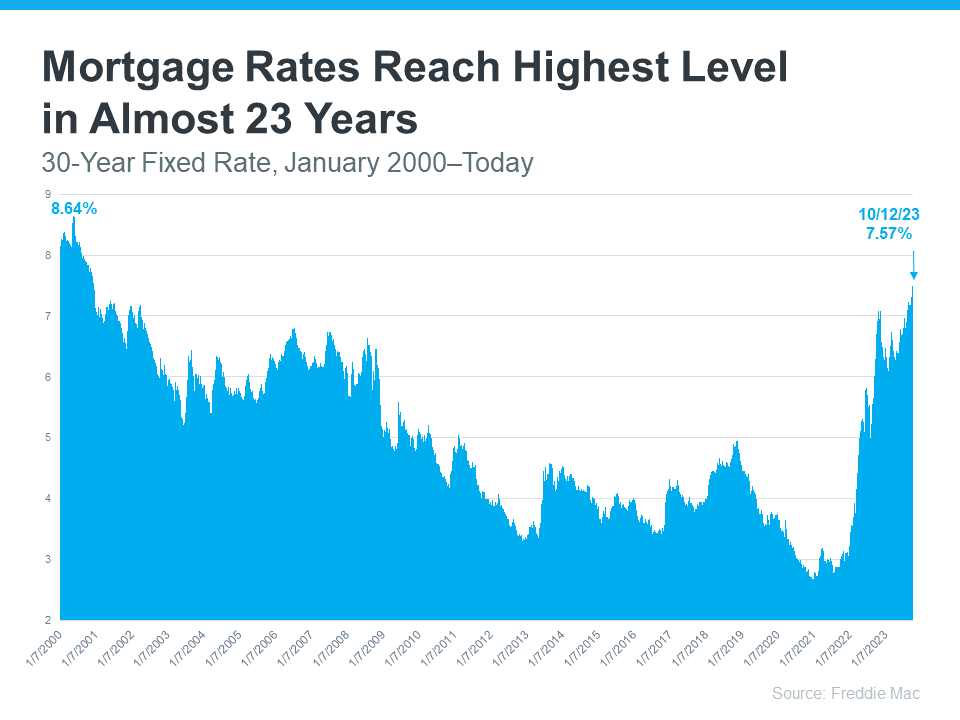

Mortgage rates have recently been on the rise, garnering substantial attention from the media. You may have noticed headlines stating that rates have reached their highest level in over two decades. This surge in mortgage rates can leave potential homebuyers feeling apprehensive, so it’s essential to understand how these changes affect you and your real estate plans.

Mortgage rates have recently been on the rise, garnering substantial attention from the media. You may have noticed headlines stating that rates have reached their highest level in over two decades. This surge in mortgage rates can leave potential homebuyers feeling apprehensive, so it’s essential to understand how these changes affect you and your real estate plans.

How Higher Mortgage Rates Affect Home Affordability

Undeniably, mortgage rates are currently higher than they have been in recent years. When interest rates rise, it directly impacts the overall affordability of homes. Here’s how it works: As rates increase, the cost of borrowing money to purchase a home also rises. Consequently, your monthly mortgage payments for your future home loan increase as well.

The Urban Institute provides valuable insights into how this situation affects both buyers and sellers:

“When mortgage rates go up, monthly housing payments on new purchases also increase. For potential buyers, increased monthly payments can reduce the share of available affordable homes. Additionally, higher interest rates mean fewer homes on the market, as existing homeowners have an incentive to hold on to their home to keep their low-interest rate.”

Some individuals are considering delaying their homebuying plans due to the current mortgage rate environment. But the crucial question is whether this is a prudent strategy.

Where Will Mortgage Rates Go From Here?

If you’re eagerly anticipating a drop in mortgage rates, you’re not alone. Many are waiting for that change, but the reality is that no one can predict when or if it will happen. Even experts cannot offer certainty about future mortgage rate trends.

While forecasts suggest that rates may decrease in the coming months, recent data reveals an upward trajectory in rates. This inconsistency underscores the inherent challenges of predicting mortgage rates.

The best advice for your real estate move is this: don’t attempt to control the uncontrollable. This includes trying to time the market or predict future mortgage rate fluctuations. As CBS News advises:

“If you’re in the market for a new home, experts typically recommend focusing your search on the right home purchase — not the interest rate environment.”

Instead, concentrate on assembling a team of skilled professionals, which should include a trusted lender and real estate agent. These experts can provide you with insights into the market’s current conditions and help you navigate the uncertainties. Whether you need to relocate due to a job change, want to be closer to family, or are undergoing another significant life change, the right team can help you achieve your goal, even in the present rate environment.

Bottom Line:

The best advice for your real estate endeavor is to refrain from attempting to control the uncontrollable – especially mortgage rates. Even experts cannot guarantee the future direction of rates. Instead, focus on building a team of trusted professionals who can keep you well-informed. When you’re ready to initiate the process, let’s connect.

If you’re interested in more information about mortgage rates, home buying, or building your real estate team, don’t hesitate to reach out. Our experienced professionals are here to assist you every step of the way.